Cloud Integration

1. Overview

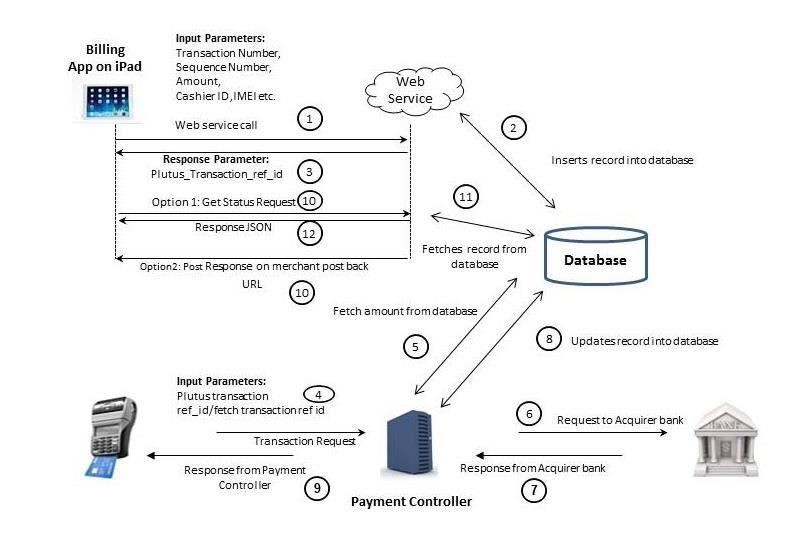

This document provides a solution to integrate billing applications on tablet, smartphone, or any other device without relying on local connectivity interfaces such as serial cable, USB cable, Bluetooth, NFC, etc. By leveraging cloud-based integration, this approach eliminates the need to support multiple local interfaces, ensuring seamless compatibility across diverse devices. Cloud based integration defines a transaction mapper on the cloud. This mapper is nothing but a hosted service by Pine Labs. Merchant’s Billing application on any device can consume this web-based API to post the transaction data into the mapper. In return, a Unique Plutus transaction reference ID (PTRID, referred here after) gets generated and sent back to the merchant’s billing application. This PTRID is used on the Plutus terminal to accept payment against the transaction in the subject. The charge slip is generated on the Plutus terminal once payment is accepted. Merchant’s billing application can use another web API to fetch the transaction status along with relevant details using PTRID.

2. Who can use this document?

This document can be used by developers, architects, and product managers who want to carry out integration or understand how cloud-based Plutus integration works.

3. Overview of Transaction Flow

This section provides the transaction lifecycle/workflow.

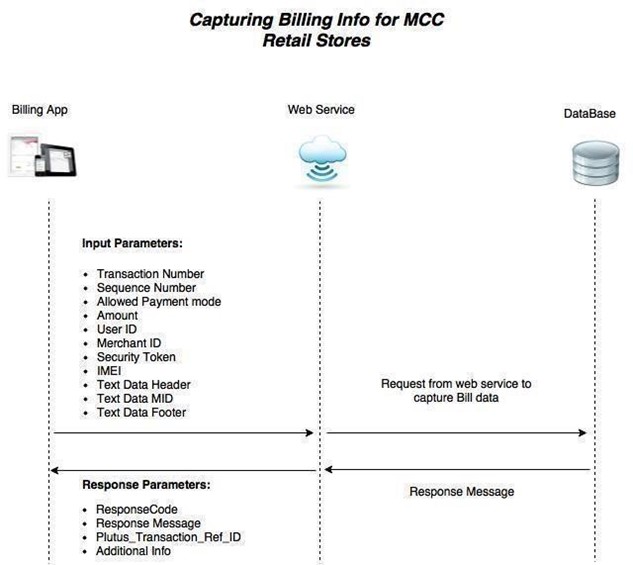

3.1 Capturing bill information

Pine Labs will host RESTful JSON web service and expose it for integration with merchant PoS in the tablet/smart phone-based billing application. A given bill can be paid by one payment instrument or tender, or it can undergo split tendering.

If it is split tendering, the billing application will send each split line item for that transaction separately with a different sequence number.

UAT URL : https://www.plutuscloudserviceuat.in:8201

METHOD : POST

In response, the Payment controller will send a numeric Plutus transaction reference ID to the billing application corresponding to each transaction number and sequence number pair. For each split tender of a given

transaction, Plutus will return a different Plutus transaction reference ID.

The cashier will proceed with payment using Pine Labs terminal. Refer to the following section for furthr details on this process.

After payment, the transaction status should be fetched by the billing application or can optionally be pushed to the Merchant’s server if the merchant wants to expose the hosted service for it. Details of the fetching/update of post-payment status are given below.

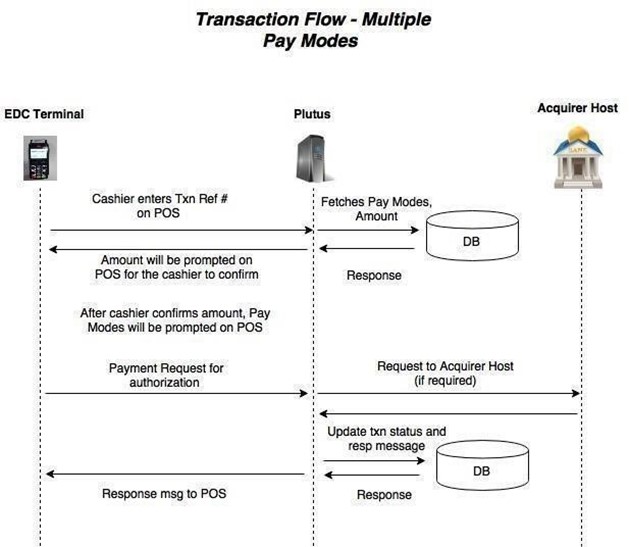

3.2 Payment at Pine Labs terminal

- Pine Labs terminal has two payment options:

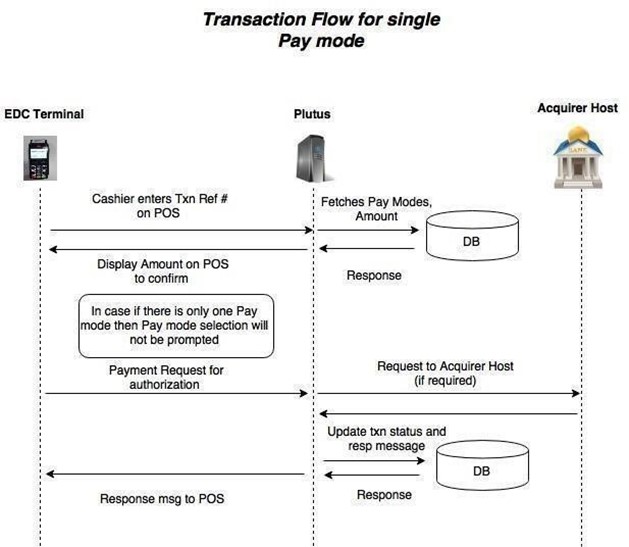

- The cashier can enter the Plutus transaction reference ID on the Pine Labs terminal. Plutus will fetch the amount and pay modes information and prompt on the terminal to select the payment mode. The transaction will proceed based on the selected pay mode. If only one payment mode is available, then it will not prompt for the selection of a payment mode.

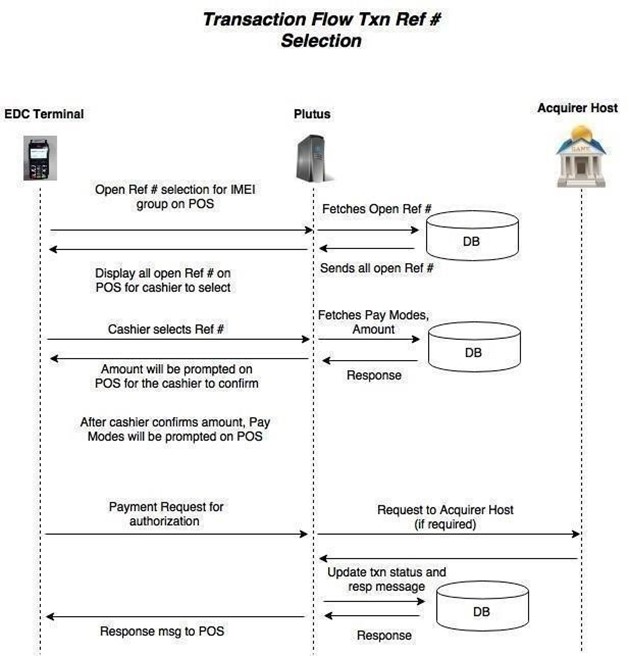

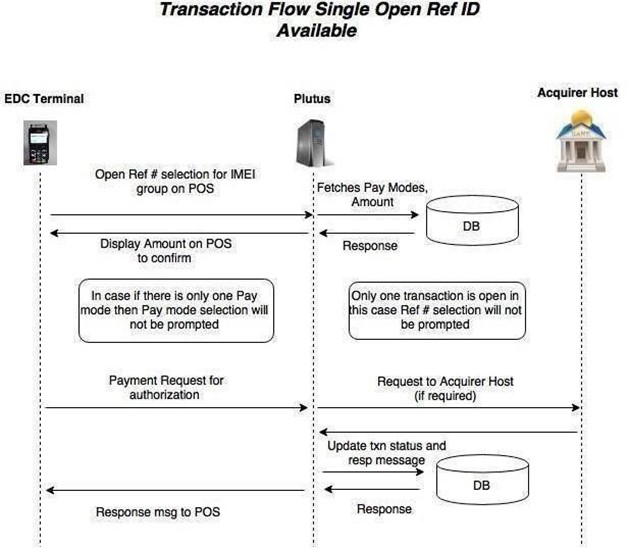

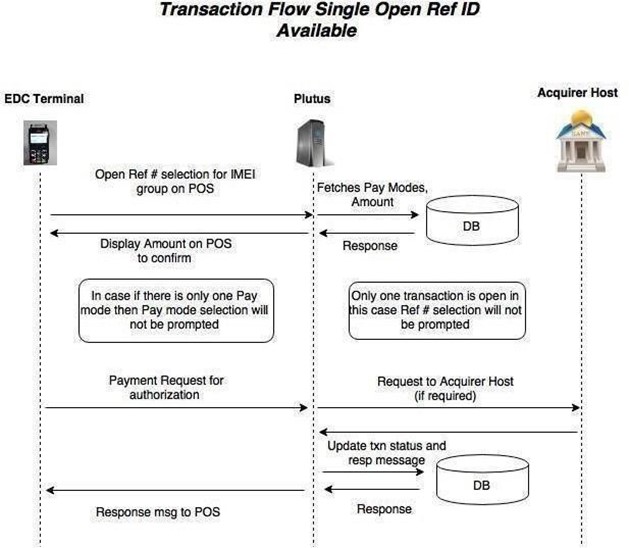

- The cashier can retrieve all open transaction reference IDs for all valid IMEIs attached to the POS. He will select the appropriate transaction reference ID and proceed with the transaction. If there is only one transaction open, then Plutus terminal will prompt “Confirm Amount? xxxxxx.xx”. After confirmation, the payment mode will be shown. If the payment mode is fixed to one type, then this screen for selecting payment modes will not be shown.

- On receiving response from the acquiring host, the transaction status and response will be updated on the Pine Labs server. This is the data which will be sent back to the billing PoS or Merchant site when the payment status is inquired about. Details of the final payment status will be provided in the next section.

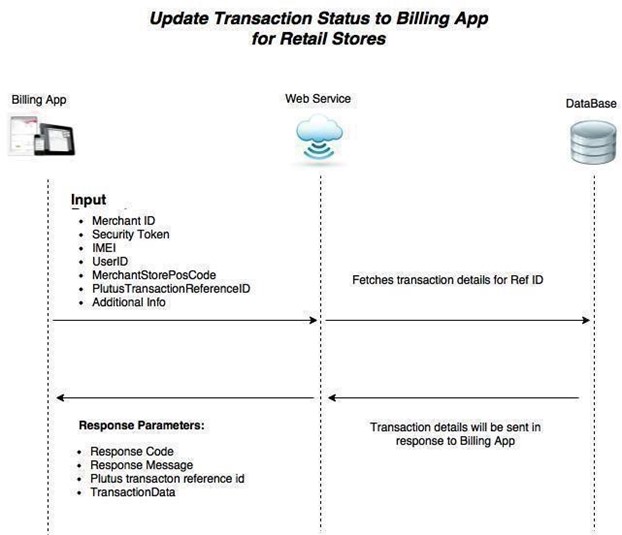

3.3 Update final status to billing application

- Pine Labs will provide two options to the Merchant Billing Application to update transaction status:

- Fetch status via API call:

- Input: Plutus transaction reference ID.

- Output: Response JSON packet containing transaction details

- The merchant will share a URL for posting back the transaction data. Pine Labs will post transaction data to this URL for the given Plutus transaction reference ID.

- Fetch status via API call:

- The Pine Labs Plutus Terminal will also have a menu option to obtain transaction status based on the Plutus transaction reference ID.

4. Security

- The merchant will be given unique merchant ID and Token which needs to be sent with each API request.

- Merchant needs to upload valid IMEIs of devices that will be used to perform the transaction. Bulk

uploads of IMEIs to be provisioned on Pine Labs UI. There will also be an API exposed for the

merchant to upload a list of PoS numbers. This is primarily to avoid the fraudulent transaction. It

can later be used to map the PoS with the merchant store code. This is an optional feature which

can be enabled at the merchant level. This mapping will help in two ways.

- It will restrict fraudulent payment fulfilment simply by entering transaction ID on any Plutus POS. Payments originating from the specific tablet or device can be completed on any Plutus terminal within the same store.

- In case, if one-to-one or many-to-one relationship exists between the tablet/devices and the Plutus terminal, and split payment is not required for a given transaction, then the cashier will not need to enter the Plutus Transaction reference ID. The assumption being made here is that every previous transaction has been closed and only one transaction remains open.

- There will be an option for the merchant to blacklist given IMEI. (In case a device is lost). In this case the transactions originating from such devices will not be allowed for payments.

- The cashier ID can also be used for mapping in place of IMEI.

5. Upload Billed Transaction API:

5.1 Request Parameters:

| S.No. | Parameter Name | Description | Type | Sample Value | Mandatory(O)/Optional(O) |

|---|---|---|---|---|---|

| 1 | TransactionNumber | This field is a unique transaction identifier generated by the billing application. | AN | MP2341203151231234 | M |

| 2 | SequenceNumber | If a single bill is split into multiple transactions, each transaction is allotted a sequence number starting with 1. | N | 1 | M |

| 3 | AllowedPaymentMode | Allowed payment modes. Any one or a combination of the listed modes. | AN | 1|2 | M |

| 4 | Amount | Amount to be processed in paisa. | N | 100000 | M |

| 5 | UserID | Cashier ID. | AN | RAVI C | O |

| 6 | MerchantID | Will be allotted by Pine Labs to the Merchant. | N | 1234 | M |

| 7 | SecurityToken | Will be allotted by Pine Labs to the Merchant. | AN | 70D7509C-0A90-4938-A7F9-DB99B9B841D9 | M |

| 8 | StoreID | Merchant Store ID | N | 61607 | M |

| 9 | ClientID | POS/Client ID | N | 307639 | C |

| 10 | TotalInvoiceAmount | Total invoice amount in paisa. | N | 500000 | O |

| 11 | AdditionalInfo | Reserved for Future Use. It will be an array of JSON objects with Tag and Value pair. | AN | O | O |

| 12 | AutoCancelDurationInMinutes | Request canceled automatically if not successful on the Swipe machine. | N | 5 | O |

| 13 | PaperPOSID | Pine Labs machine client ID. | N | 12365 | M |

| 14 | PaperPOSTxnOptionToDisplay | N | 2 | M | |

| 15 | PaperPOSTxnIdentifier | N | 2 | M | |

| 16 | OEM ID | Manufacturer Identification for Pinelabs. | N | 139 | M for Brand EMI |

| 17 | ProductCode | Product Identification for Pinelabs. | N | 708 | M for Brand EMI |

| 18 | Customer Mobile Number | AN | 9643999539 | O | |

| 19 | Customer Email ID | AN | abc@pinelabs.com | O | |

| 20 | OriginalPlutusTransactionReferenceID | Contains PTRN in case of dependent transactions (like Void, sale complete). | N | 12345678 | M |

| 21 | TransactionId | Contains the transaction Id of dependent card sale transaction which you want to refund. | N | 4295207237 | M |

5.2 Additional Request Parameters for UPI Sale (GST Details)

Below is mandatory parameter for UPI GST QR:

| S.No. | Parameter Name | Description | Type | Sample Value | Mandatory(M) Optional(O) |

| 1 | InvoiceDate | This field is used to capture the bill invoice date. | GMT format | 2019-06-11T13:21:50+05:30 | Mandatory for GST QR |

| 2 | Invoicenumber (existing field) | This field is used to capture the bill/invoice no. | AN | TXN123456 | Mandatory for GST QR |

| 3 | GstIn | The merchant populate GSTIN value under this tag. | String | 09AABCU9603R112 | Mandatory for GST QR |

| 4 | GstBrkUp | It will contain the break-up of GST amount. | String | CGST:08.45|SGST:08.45 | Mandatory for GST QR |

| Break up of GST amount GST:amount| CGST:amount| SGST:amount| IGST:amount| CESS:amount| GSTIncentive:amount | GSTPCT:percentage. |

5.3 Additional Request Parameters for PhonePe (GST Details)

Below is mandatory parameter for PhonePe GST QR:

| S.No. | Parameter Name | Description | Type | Sample Value | Mandatory(M)/Optional(O) |

| 1 | InvoiceDate | This field is used to capture the bill invoice date. | GMT format | 2019-06-11T13:21:50+05:30 | Mandatory for GST QR |

| 2 | Invoicenumber (existing field) | This field is used to capture the bill/invoice no. | AN | TXN123456 | Mandatory for GST QR |

| 3 | GstIn | The merchant populates GSTIN value under this tag. | String | 09AABCU9603R112 | Mandatory for GST QR |

| 4 | GstBrkUp | It will contain the break-up of GST amount. Break up of GST amount GST:amount| CGST:amount| SGST:amount| IGST:amount| CESS:amount| GSTIncentive:amount| GSTPCT:percentage. | String | GST:16.90|CGST:08.45|SGST:08.45 | Mandatory for GST QR |

5.4 Example Request Packet (Also included dummy Additional Info Tags):

5.4.1 Example Request JSON

JSON

{ “TransactionNumber”:“MP2341203151231234”, “SequenceNumber”:"1", “AllowedPaymentMode”:"1", “Amount”:100000, “UserID”:“RAVI”, “MerchantID”:"1234", “SecurityToken”:“70D7509C-0A90-4938-A7F9-DB99B9B841D9”, “StoreID”:“61607”, "ClientID":"307639", "AutoCancelDurationInMinutes":5, "TotalInvoiceAmount":500000, "AdditinalInfo": [ { "Tag": "1001", "Value": "XYZ" }, { "Tag": "1002", "Value": "ABC" } ] }

5.4.2 Example JSON Request for Brand EMI

JSON

{ "TransactionNumber": "17022002", "SequenceNumber": "1", "AllowedPaymentMode": "6", "StoreID": "04155462", "Amount": "1500000", "UserID": "Skava store", "MerchantID": "2093", "SecurityToken": "85b93e2c-372b-4b40-95a8-4ead39310bde", "ClientID": "9910757360", "oemid": "139", "ProductCode": "999113972", "CustomerMobileNumber": "9643999539", "CustomerEmailID": "farhan.jafri@pinelabs.com", "SchemeInfo": [{ "Tag": "RuleID", "Value": "1048" }, { "Tag": "SchemeCode", "Value": "1629" }, { "Tag": "TenureID", "Value": "06" } ] }

5.4.3 Example JSON Request for Paper POS

JSON

{ "TransactionNumber": "MP23412-0400000-007", "SequenceNumber": "478", "AllowedPaymentMode": "19", "StoreID": "61823000", "Amount": "500", "MerchantID": "7539", "SecurityToken": "0ab4a438-4c03-4adb-88e5-aaa949260c8f", "ClientID": "1845555552", "AutoCancelDurationInMinutes" : 5, "PaperPOSID":217306, "PaperPOSTxnOptionToDisplay":2, "PaperPOSTxnIdentifier":2 }

5.4.4 Example JSON Request for Bank EMI

JSON

{ "TransactionNumber": "Test-1039", "SequenceNumber": "144", "AllowedPaymentMode": "20", "TotalInvoiceAmount": "600000", "StoreID": "061607000", "Amount": "600000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "ClientID": "307639", "SchemeInfo" : [ { "Tag" : "SchemeCode", "Value" : "6296" }, { "Tag" : "RuleID", "Value" : "4570" }, { "Tag" : "TenureID", "Value" : "6" } ] }

5.4.5 Example JSON Request for Amazon Pay

JSON

{ "TransactionNumber": "Test-1039", "SequenceNumber": "2027", "AllowedPaymentMode": "10", "TotalInvoiceAmount": "900", "StoreID": "159640000", "Amount": "900", "UserID": "krish", "MerchantID": "40605", "SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48", "ClientID": 307639, "BankCode": "17" }

5.4.6 Example JSON Request For UPI Sale (with GST)

JSON

{ "TransactionNumber": "SEQ-539", "SequenceNumber": 1, "AllowedPaymentMode": "10", "GstIn":"09AABCU9603R112", "GstBrkUp":" CGST:08.45|SGST:08.45", "InvoiceDate":"2019-06-11T13:21:50+05:30", "invoicenumber": " TXN123456", "TotalInvoiceAmount": "100", "Amount": "100", "AutoCancelDurationInMinutes" : 120, "UserID": "RAVI", "MerchantID": 11866, "SecurityToken": "1b162a3a-7412-4fdd-8564-7d58c6d91b79", "StoreID": "1201056000", "ClientID": "11111125551212", }

5.4.7 Example JSON Request For (ICICI, HDFC, Federal Bank) Cardless Bank EMI Sale

JSON

{ "TransactionNumber": "Test-1039", "SequenceNumber": "146", "AllowedPaymentMode": "23", "TotalInvoiceAmount": "600000", "StoreID": "159640000", "Amount": "600000", "UserID": "krish", "MerchantID": "40605", "SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48", "ClientID": 307639 }

5.4.8 Example JSON Request For (ICICI, HDFC, Federal Bank) Cardless Brand EMI Sale

JSON

{ "TransactionNumber": "6451000662", "SequenceNumber": 32364, "AllowedPaymentMode": "24", "invoicenumber": "KK45613", "TotalInvoiceAmount": "17000", "StoreID": "159640000", "Amount": "17000", "UserID": "RAVI", "MerchantID": "40605", "SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48", "ClientID": 307639, "oemid":"235", "productcode":"151214", "SerialNumberofProductSold" : "livepl1", "CustomerMobileNumber" : "7507036654", "CustomerEmailID" : "krishna.kant@pinelabs.com" }

5.4.9 Example JSON Request For Federal Bank – Void Cardless Bank EMI

JSON

{ "TransactionNumber": "Test-10560", "SequenceNumber": "44", "AllowedPaymentMode": "23", "TotalInvoiceAmount": "200000", "StoreID": "061607000", "CustomerMobileNumber": "9560312525", "Amount": "200000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "TxnType": 1, "OriginalPlutusTransactionReferenceID" : 6103, "ClientID": 307639 }

5.4.10 Example JSON Request For Federal Bank – Void Cardless Brand EMI

JSON

{ "TransactionNumber": "Test-10560", "SequenceNumber": "44", "AllowedPaymentMode": "24", "TotalInvoiceAmount": "120000", "StoreID": "061607000", "CustomerMobileNumber": "9560312525", "Amount": "120000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "TxnType" : 1, "OriginalPlutusTransactionReferenceID" : 237967, "ClientID": 307639 }

5.4.11 Example JSON Request For HDFC Flexipay - PoS (Pay Later)

JSON

{ "TransactionNumber": "Test-10560", "SequenceNumber": "44", "AllowedPaymentMode": "26", "TotalInvoiceAmount": "300000", "StoreID": "061607000", "CustomerMobileNumber" : "9560312525", "Amount": "300000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "ClientID": 307639 }

5.4.12 Example JSON Request for linked refund of card sale transaction

JSON

{ "TransactionNumber": "MP2341203151231234", "SequenceNumber": 1, "AllowedPaymentMode": "1", "Amount": 100000, "UserID": "RAVI", "MerchantID": 1234, "SecurityToken": "70D7509C-0A90-4938-A7F9-DB99B9B841D9", "ClientID": "1234567890", "StoreID": "MP123015", "AutoCancelDurationInMinutes": 5, "TotalInvoiceAmount": 500000, "AdditinalInfo": [{ "Tag": "1001", "Value": "XYZ" }, { "Tag": "1002", "Value": "ABC" } ], "TxnType": 3, "TransactionId":"4295207237" }

5.4.13 Example JSON request for myEMI transaction

JSON

Request: { "TransactionNumber": "SEQ-AJAY_MAR_0025", "SequenceNumber": 1, "AllowedPaymentMode": "37", "ClientID": "11111125551356", "UserID": "RAVI", "MerchantID": "30090", "SecurityToken": "52dd0401-2db0-4f2f-8c0e-d71171688182", "TotalInvoiceAmount": "1000", "StoreID": "1225598000", "Amount": "250000", "TxnType": 0, "CustomerMobileNumber": "9886899363", "CustomerEmailID": "aman.shukla@pinelabs.com", "invoicenumber": "Abc4569" }

5.4.14 Example JSON request for Sale With Tip transaction

JSON

Request: { "TransactionNumber": "SEQ-U_JAN_0001", "SequenceNumber": 1, "AllowedPaymentMode": "41", "ClientID": "11111125551356", "UserID": "RAVI", "MerchantID": "30090", "SecurityToken": "52dd0401-2db0-4f2f-8c0e-d71171688182", "TotalInvoiceAmount": "1000", "StoreID": "1225598000", "Amount": "250000", "TxnType": 0, "CustomerMobileNumber": "9886899363", "CustomerEmailID": "aman.shukla@pinelabs.com", "invoicenumber": "Abc4569" }

5.4.15 Example JSON request for Pay By Link transaction

JSON

{ "TransactionNumber": "Brand_EMI_280988235235236262", "SequenceNumber": 411, "AllowedPaymentMode": "6", "MerchantID": "6727", "SecurityToken": "f14c99e5-149c-44c6-9046-224026a871b5", "ClientID": "111000155890", "StoreID": "61078001", "Amount": "990000", "AutoCancelDurationInMinutes": 10, "PBLAutoCancelDurationInMinutes": 20, "TxnType": 0 , "UserID": "test", "TotalInvoiceAmount": "100", "ItemCategoryCodeForInstantDiscount": "0", "oemid": "244", "productcode": "45347845", "SerialNumberofProductSold" :"1234567890", "CustomerMobileNumber": "8789967057", "CustomerEmailID": "test@pinelabs.com", "invoicenumber": "TEST244561" }

5.4.16 Example JSON request for Rewards transaction

JSON

Request: { "TransactionNumber": "SM-CBIS-2024-001", "SequenceNumber": "1", "AllowedPaymentMode": "3", "invoicenumber": "87654321", "TotalInvoiceAmount": "10000", "StoreID": "1221783001", "ClientID": "129846363", "Amount": "10000", "MerchantID": "29946", "SecurityToken": "a12f588c-3158-4527-b6fa-ebaf1fbcbfa1", "TxnType": 0 }

5.5 Response Parameters:

| S No. | Parameter Name | Description | Type |

| 1 | ResponseCode | 0 in case of Success Non 0 means failure. | N |

| 2 | ResponseMessage | Description of error in case of Declined otherwise “APPROVED”. | AN |

| 3 | PlutusTransactionReferenceID | Unique numeric Value linked with the transaction. | N |

| 4 | AdditionalInfo | Reserved for Future Use. It will be array of JSON objects with Tag and Value pair. | AN |

5.5.1 Response Example

JSON packet for success response

JSON

{ "ResponseCode": 0, "ResponseMessage": "APPROVED", "PlutusTransactionReferenceID": 501 }

5.5.2 JSON response packet for declined transaction

JSON

{ "ResponseCode": 1, "ResponseMessage": "INVALID SOURCE IMEI/DEVICE", "PlutusTransactionReferenceID": 0 }

6. GetStatus API:

Merchant billing Application will be able to get the status of performed transaction by using this API.

6.1 Request Parameters:

| S. No. | Parameter | Description | Type | Sample Value | Mandatory(M)/Optional(O) |

| 1 | MerchantID | Will be allotted by Pine Labs to Merchant. | N | 1234 | M |

| 2 | SecurityToken | Will be allotted by Pine Labs to Merchant. | AN | 70D7509C-0A90-4938- A7F9-DB99B9B841D9 | M |

| 3 | StoreID | Merchant Store ID. | N | 61607 | M |

| 4 | ClientID | POS/Client ID. | N | 307639 | C |

| 5 | UserID | Cashier ID. | AN | RAVI | C |

| 6 | PlutusTransactionReferenceID | Unique numeric Value linked with the transaction received from Pine Labs in original request. | N | 123456 | M |

| 7 | TransactionNumber | Unique transaction identifier generated by billing Application for original transaction. This is an optional field, if sent will be validated against original transaction. | AN | MP2341203151231234 | O |

| 8 | AdditionalInfo | Reserved for Future Use. It will be array of JSON objects with Tag and Value pair. | AN | O |

6.1.1 For Retail Stores

Example JSON

JSON

{

“MerchantID”: "1234",

“SecurityToken”: “70D7509C-0A90-4938-A7F9-DB99B9B841D9”,

"ClientID": “123456789012345”,

“UserID”: “RAVI”,

"StoreID": "12301001",

"PlutusTransactionReferenceID": 501

}

JSON

{ “MerchantID”: "1234", “SecurityToken”: “70D7509C-0A90-4938-A7F9-DB99B9B841D9”, "ClientID": “123456789012345”, “UserID”: “RAVI”, "StoreID": "12301001", "PlutusTransactionReferenceID": 501 }

6.2 Response Parameter:

| S No. | Parameter | Description | Type |

| 1 | ResponseCode | 0 in case of Success Non 0 means failure. | N |

| 2 | ResponseMessage | Description of error in case of Declined otherwise “APPROVED”. | AN |

| 3 | PlutusTransactionReferenceID | Unique numeric Value linked with the transaction. | N |

| 4 | TransactionData | It will be array of JSON objects with Tag and Value pair. | AN |

6.2.1 Response Example

JSON packet for success response

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 20179066, "TransactionData":[ { "Tag": "TID", "Value": "f7874878" }, { "Tag": "MID", "Value": "120000123123123" }, { "Tag": "PaymentMode", "Value": "CARD" }, { "Tag": "Amount", "Value": "351" }, { "Tag": "BatchNumber", "Value": "19" }, { "Tag": "RRN", "Value": "000792514130" }, { "Tag": "ApprovalCode", "Value": "849035" }, { "Tag": "Invoice Number", "Value": "46" "Tag": "Card Number", "Value": "************5664" }, { }, { "Tag": "IsPartialPayByPointsTxn", "Value": "True" }, { "Tag": "PartialAmountByCard", "Value": "0" }, { "Tag": "PartialAmountByReward", "Value": "30000" } { "Tag": "Expiry Date", "Value": "XXXX" }, { "Tag": "Card Type", "Value": "VISA" }, { "Tag": "Acquirer Id", "Value": "20" }, { "Tag": "Acquirer Name", "Value": "FEDERAL" }, { "Tag": "Transaction Date", "Value": "26022020" }, { "Tag": "Transaction Time", "Value": "135456" }, { "Tag": "AmountInPaisa", "Value": "35100" }, { "Tag": "OriginalAmount", "Value": "35100" }, { "Tag": "FinalAmount", "Value": "35100" } ] }

6.2.2 Response Example of PhonePe

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 28757, "TransactionData":[ { "Tag": "TID", "Value": "0" }, { "Tag": "MID", "Value": "0" }, { "Tag": "PaymentMode", "Value": "PHONEPE" }, { "Tag": "Amount", "Value": "1" }, { "Tag": "BatchNumber", "Value": "9162" }, { "Tag": "RRN", "Value": "" }, { "Tag": "ApprovalCode", "Value": "" }, { "Tag": "Invoice Number", "Value": "105" }, { "Tag": "Card Number", }, { "Value": "" }, { "Tag": "Expiry Date", "Value": "" }, { "Tag": "Card Type", "Value": "" }, { "Tag": "Acquirer Id", "Value": "00" }, { "Tag": "Acquirer Name", "Value": "WALLET" }, { "Tag": "Transaction Date", "Value": "10092018" }, { "Tag": "Transaction Time", "Value": "172407" }, { "Tag": "AmountInPaisa", "Value": "100" }, { "Tag": "OriginalAmount", "Value": "100" }, { "Tag": "FinalAmount", "Value": "0" } ] }

6.2.3 Response Example of UPI PayTM

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 28760, "TransactionData":[ { "Tag": "TID", "Value": "0" }, { "Tag": "MID", "Value": "0" }, { "Tag": "Payment Mode", "Value": "PayTm" }, { "Tag": "Amount", "Value": "1" }, { "Tag": "BatchNumber", "Value": "9162" }, { "Tag": "RRN", "Value": "101XZ8UWFW6Q" }, { "Tag": "ApprovalCode", "Value": "" }, { "Tag": "Invoice Number", "Value": "107" }, { "Tag": "Card Number", "Value": "" }, { "Tag": "Expiry Date", "Value": "" }, { "Tag": "Card Type", "Value": "" }, { "Tag": "Acquirer Id", "Value": "10" }, { "Tag": "Acquirer Name", "Value": "PayTM QR" }, { "Tag": "Transaction Date", "Value": "09102018" }, { "Tag": "Transaction Time", "Value": "174506" }, { "Tag": "AmountInPaisa", "Value": "100" }, { "Tag": "OriginalAmount", "Value": "100" }, { "Tag": "FinalAmount", "Value": "0" } ] }

6.2.4 Response Example of UPI Airtel Bank

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 234480, "TransactionData": [ { "Tag": "TID", "Value": "110000005" }, { "Tag": "MID", "Value": "180704" }, { "Tag": "PaymentMode", "Value": "UPI AIRTEL BANK" }, { "Tag": "Amount", "Value": "1" }, { "Tag": "BatchNumber", "Value": "9127" }, { "Tag": "RRN", "Value": "511634" }, { "Tag": "ApprovalCode", "Value": "000015" }, { "Tag": "Invoice Number", "Value": "107" }, { "Tag": "Card Number", "Value": "" }, { "Tag": "Expiry Date", "Value": "" }, { "Tag": "Card Type", "Value": "" }, { "Tag": "Acquirer Id", "Value": "11" }, { "Tag": "Acquirer Name", "Value": "AIRTEL BANK" }, { "Tag": "Transaction Date", "Value": "10102018" }, { "Tag": "Transaction Time", "Value": "175914" }, { "Tag": "AmountInPaisa", "Value": "100" }, { "Tag": "Masked Moblie Number", "Value": "110000005000015" }, { "Tag": "OriginalAmount", "Value": "100" }, { "Tag": "FinalAmount", "Value": "0" } ] }

6.2.5 Response Example of Brand EMI

Sample Get Status Response

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 56106, "TransactionData":[ { "Tag": "TID", "Value": "39784111" }, { "Tag": "MID", "Value": "" }, { "Tag": "PaymentMode", "Value": "BRAND EMI" }, { "Tag": "Amount", "Value": "15000" }, { "Tag": "BatchNumber", "Value": "9020" }, { "Tag": "RRN", "Value": "000020" }, { "Tag": "ApprovalCode", "Value": "00" }, { "Tag": "Invoice Number", "Value": "89" }, { "Tag": "Card Number", "Value": "************0056" }, { "Tag": "Expiry Date", "Value": "XXXX" }, { "Tag": "Card Type", "Value": "VISA" }, { "Tag": "Acquirer Id", "Value": "02" }, { "Tag": "Acquirer Name", "Value": "ICICI" }, { "Tag": "Transaction Date", "Value": "17022020" }, { "Tag": "Transaction Time", "Value": "184739" }, { "Tag": "AmountInPaisa", "Value": "1500000" }, { "Tag": "EmiTenureMonths", "Value": "6" }, { "Tag": "EmiInterestRatePerc", "Value": "120000" }, { "Tag": "EmiAmountInPaise", "Value": "258822" }, { "Tag": "EmiTotalDiscountCashbackAmountInPaise", "Value": "0" }, { "Tag": "EmiTotalDiscountCashbackPerc", "Value": "0" }, { "Tag": "EmiProductCode", "Value": "999113972" }, { "Tag": "EmiProductName", "Value": "All Dental Services" }, { "Tag": "EmiProductSerial", "Value": "" }, { "Tag": "EmiManufacturerId", "Value": "139" } ] }

6.2.6 Response Example of Paper POS

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 20224960, "TransactionData": [ { "Tag": "TID", "Value": "41303201" }, { "Tag": "MID", "Value": "HDFC000000174318" }, { "Tag": "PaymentMode", "Value": "PAPER POS" }, { "Tag": "Amount", "Value": "1" }, { "Tag": "BatchNumber", "Value": "9075" }, { "Tag": "RRN", "Value": "005822103166" }, { "Tag": "ApprovalCode", "Value": "803378" }, { "Tag": "Invoice Number", "Value": "116" }, { "Tag": "Card Number", "Value": "" }, { "Tag": "Expiry Date", "Value": "" }, { "Tag": "Card Type", "Value": "" }, { "Tag": "Customer VPA", "Value": "test@ybl" }, { "Tag": "Acquirer Id", "Value": "19" }, { "Tag": "Acquirer Name", "Value": "HDFC UPI" }, { "Tag": "Transaction Date", "Value": "27022020" }, { "Tag": "Transaction Time", "Value": "115935" }, { "Tag": "AmountInPaisa", "Value": "100" }, { "Tag": "OriginalAmount", "Value": "100" }, { "Tag": "FinalAmount", "Value": "0" } ] }

6.2.7 Response Example of Bank EMI

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 5246, "TransactionData": [ { "Tag": "TID", "Value": "17777700" }, { "Tag": "MID", "Value": " " }, { "Tag": "PaymentMode", "Value": "BANK EMI" }, { "Tag": "Amount", "Value": "6000" }, { "Tag": "BatchNumber", "Value": "6" }, { "Tag": "RRN", "Value": "000020" }, { "Tag": "ApprovalCode", "Value": "00" }, { "Tag": "Invoice Number", "Value": "7" }, { "Tag": "Card Number", "Value": "************6001" }, { "Tag": "Expiry Date", "Value": "XXXX" }, { "Tag": "Card Type", "Value": "MAESTRO" }, { "Tag": "Acquirer Id", "Value": "01" }, { "Tag": "Acquirer Name", "Value": "HDFC" }, { "Tag": "Transaction Date", "Value": "06052020" }, { "Tag": "Transaction Time", "Value": "145523" }, { "Tag": "AmountInPaisa", "Value": "600000" }, { "Tag": "BankEmiTenureMonths", "Value": "3" }, { "Tag": "BankEmiInterestRatePerc", "Value": "100000" }, { "Tag": "BankEmiAmountInPaise", "Value": "172163" }, { "Tag": "BankEmiTotalDiscountCashbackAmountInPaise", "Value": "20000" }, { "Tag": "BankEmiTotalDiscountCashbackPerc", "Value": "120000" } ] }

6.2.8 Response Example of Amazon Pay

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 5259, "TransactionData": [ { "Tag": "TID", "Value": "17000172" }, { "Tag": "MID", "Value": "A3JMHLGG3U4521" }, { "Tag": "PaymentMode", "Value": "AMAZON PAY" }, { "Tag": "Amount", "Value": "9" }, { "Tag": "BatchNumber", "Value": "9016" }, { "Tag": "RRN", "Value": "8123139 -6050" }, { "Tag": "ApprovalCode", "Value": "000018" }, { "Tag": "Invoice Number", "Value": "110" }, { "Tag": "Card Number", "Value": "" }, { "Tag": "Expiry Date", "Value": "" }, { "Tag": "Card Type", "Value": "" }, { "Tag": "Acquirer Id", "Value": "17" }, { "Tag": "Acquirer Name", "Value": "AmazonPay" }, { "Tag": "Transaction Date", "Value": "08052020" }, { "Tag": "Transaction Time", "Value": "161209" }, { "Tag": "AmountInPaisa", "Value": "900" }, { "Tag": "OriginalAmount", "Value": "900" }, { "Tag": "FinalAmount", "Value": "0" } ] }

6.2.9 Response Example of Amazon Pay with Barcode

Request JSON

{

Request:

{

"TransactionNumber": "Test-1039",

"SequenceNumber": "2029",

"AllowedPaymentMode": "21",

"TotalInvoiceAmount": "100",

"StoreID": "159640000",

"Amount": "100",

"UserID": "krish",

"MerchantID": "40605",

"SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48",

"ClientID": "307639"

}

}

Response JSON

{ Response: { "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 5872, "TransactionData": [ { "Tag": "TID", "Value": "17000172" }, { "Tag": "MID", "Value": "A2GI92ROAM509H" }, { "Tag": "PaymentMode", "Value": "AMAZON PAY" }, { "Tag": "Amount", "Value": "1" }, { "Tag": "BatchNumber", "Value": "9169" }, { "Tag": "RRN", "Value": "4189285 -8908245" }, { "Tag": "ApprovalCode", "Value": "000169" }, { "Tag": "Invoice Number", "Value": "102" }, { "Tag": "Card Number", "Value": "" }, { "Tag": "Acquirer Id", "Value": "17" }, { "Tag": "Acquirer Name", "Value": "AmazonPay" }, { "Tag": "Transaction Date", "Value": "05022021" }, { "Tag": "Transaction Time", "Value": "154049" }, { "Tag": "AmountInPaisa", "Value": "100" }, { "Tag": "OriginalAmount", "Value": "100" }, { "Tag": "FinalAmount", "Value": "0" } ] } }

6.2.10 Response Example of Sale With Instant Discount

Response JSON

{ "ResponseCode"=0, "ResponseMessage"=APPROVED, "PlutusTransactionReferenceID"=237355, "TransactionNumber“=SEQ-234, "BankTID“=56567568, "BankMID“= , "PaymenMode“=CARD, "Amount“=500000, "ApprovalCode“=00, "RRN“=000020, "Invoice“=217, "BatchNumber“=25, "CardNumber“= ************4976, "ExpiryDate“=XXXX, "AcquirerCode“=1, "AcquirerName“=HDFC, "TransactionDate"=21092020, "TransactionTime“=115715, "CardType“=MAESTRO, "InstantDiscount“=50000 "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", }

6.2.11 Response Example of Sale Without Instant Discount

Response JSON

{ "ResponseCode"=0, "ResponseMessage“=APPROVED, "PlutusTransactionReferenceID“=237354, "TransactionNumber“=SEQ-233, "BankTID“=56567568, "BankMID“= , "PaymenMode“=CARD, "Amount“=500000, "ApprovalCode“=00, "RRN“=000020, "Invoice“=218, "BatchNumber“=25, "CardNumber“= ************4976, "ExpiryDate“=XXXX, "AcquirerCode“=1, "AcquirerName“=HDFC, "TransactionDate“=21092020, "TransactionTime“=115842, "CardType“=MAESTRO }

6.2.12 Response Example (ICICI, HDFC & Federal Bank) – Sale Cardless Bank EMI

Request JSON

{ Request: { "TransactionNumber": "Test-1039", "SequenceNumber": "146", "AllowedPaymentMode": "23", "TotalInvoiceAmount": "600000", "StoreID": "159640000", "Amount": "600000", "UserID": "krish", "MerchantID": "40605", "SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48", "ClientID": "307639" } }

Response JSON

{ Response: { "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 5731, "TransactionData": [ { "Tag": "TID", "Value": "0" }, { "Tag": "MID", "Value": "40605" }, { "Tag": "PaymentMode", "Value": "CARDLESS BANK EMI" }, { "Tag": "Amount", "Value": "17000" }, { "Tag": "BatchNumber", "Value": "9150" }, { "Tag": "RRN", "Value": "" }, { "Tag": "ApprovalCode", "Value": "" }, { "Tag": "Invoice Number", "Value": "125" }, { "Tag": "Masked Mobile Number", "Value": "******6654" }, { "Tag": "Acquirer Id", "Value": "00" }, { "Tag": "Acquirer Name", "Value": "" }, { "Tag": "Transaction Date", "Value": "23012021" }, { "Tag": "Transaction Time", "Value": "141645" }, { "Tag": "AmountInPaisa", "Value": "1700000" }, { "Tag": "BankEmiTenureMonths", "Value": "9" }, { "Tag": "BankEmiInterestRatePerc", "Value": "160000" }, { "Tag": "BankEmiAmountInPaise", "Value": "201703" }, { "Tag": "BankEmiTotalDiscountCashbackAmountInPaise", "Value": "0" }, { "Tag": "BankEmiTotalDiscountCashbackPerc", "Value": "0" }, { "Tag": "Card Less Issuer Name", "Value": "ICICI CARDLESS" }, { "Tag": "Card Less Host Txn Id", "Value": "CDL-000000007984-PRO" } ] } }

6.2.13 Response Example (ICICI, HDFC & Federal Bank) – Sale Cardless Brand EMI

Request JSON

{ Request: { "TransactionNumber": "6451000662", "SequenceNumber": 32364, "AllowedPaymentMode": "24", "invoicenumber": "KK45613", "TotalInvoiceAmount": "17000", "StoreID": "159640000", "Amount": "17000", "UserID": "RAVI", "MerchantID": "40605", "SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48", "ClientID": "307639", "oemid" :"235", "productcode":"151214", "SerialNumberofProductSold" : "livepl1", "CustomerMobileNumber" : "7507036654", "CustomerEmailID" : "krishna.kant@pinelabs.com" } }

Response JSON

{

Response:

{

"ResponseCode": 0,

"ResponseMessage": "TXN APPROVED",

"PlutusTransactionReferenceID": 5739,

"TransactionData": [

{

"Tag": "TID",

"Value": "0"

},

{

"Tag": "MID",

"Value": "40605"

},

{

"Tag": "PaymentMode",

"Value": "CARDLESS BRAND EMI"

},

{

"Tag": "Amount",

"Value": "17000"

},

{

"Tag": "BatchNumber",

"Value": "9157"

},

{

"Tag": "RRN",

"Value": ""

},

{

"Tag": "ApprovalCode",

"Value": ""

},

{

"Tag": "Invoice Number",

"Value": "105"

},

{

"Tag": "Masked Mobile Number",

"Value": "******6654"

},

{

"Tag": "Acquirer Id",

"Value": "00"

},

{

"Tag": "Acquirer Name",

"Value": ""

},

{

"Tag": "Transaction Date",

"Value": "01022021"

},

{

"Tag": "Transaction Time",

"Value": "151604"

},

{

"Tag": "AmountInPaisa",

"Value": "1700000"

},

{

"Tag": "EmiTenureMonths",

"Value": "9"

},

{

"Tag": "EmiInterestRatePerc",

"Value": "160000"

},

{

},

{

"Tag": "EmiAmountInPaise",

"Value": "188027",

"Tag": "EmiTotalDiscountCashbackAmountInPaise",

"Value": "0"

},

{

"Tag": "EmiTotalDiscountCashbackPerc",

"Value": "67800"

},

{

"Tag": "EmiProductCode",

"Value": "151214"

},

{

"Tag": "EmiProductName",

"Value": "LCD"

},

{

"Tag": "EmiProductSerial",

"Value": "livepl1"

},

{

"Tag": "EmiManufacturerId",

"Value": "235"

},

{

"Tag": "Card Less Issuer Name",

"Value": "ICICI CARDLESS"

},

{

"Tag": "Card Less Host Txn Id",

"Value": "CDL-000000008019-PRO"

}

]

}}

6.2.14 Response Example of Federal Bank – Void Cardless Bank EMI

Response JSON

{ Request: { "TransactionNumber": "Test-10560", "SequenceNumber": "44", "AllowedPaymentMode": "23", "TotalInvoiceAmount": "200000", "StoreID": "061607000", "CustomerMobileNumber" : "9560312525", "Amount": "200000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "TxnType" : 1, "OriginalPlutusTransactionReferenceID" : 6103, "ClientID": "307639" } }

Response JSON

{

Response:

{

"ResponseCode": 1008,

"ResponseMessage": "TXN VOIDED",

"PlutusTransactionReferenceID": 6103,

"TransactionData": [

{

"Tag": "TID",

"Value": "0"

},

{

"Tag": "MID",

"Value": "40605"

},

{

"Tag": "PaymentMode",

"Value": "CARDLESS BANK EMI"

},

{

"Tag": "Amount",

},

{

},

{

"Value": "2000"

},

{

"Tag": "BatchNumber",

"Value": "9224"

},

{

"Tag": "RRN",

"Value": ""

},

{

"Tag": "ApprovalCode",

"Value": ""

},

{

"Tag": "Invoice Number",

"Value": "159"

},

{

"Tag": "Masked Mobile Number",

"Value": "******6654",

"Tag": "Acquirer Id",

"Value": "00"

},

{

"Tag": "Acquirer Name",

"Value": ""

},

{

"Tag": "Transaction Date",

"Value": "14072021"

},

{

"Tag": "Transaction Time",

"Value": "195315"

},

{

"Tag": "AmountInPaisa",

"Value": "200000"

},

{

"Tag": "BankEmiTenureMonths",

"Value": "9"

},

{

},

{

},

{

},

{

"Tag": "BankEmiInterestRatePerc",

"Value": "135000"

},

{

"Tag": "BankEmiAmountInPaise",

"Value": "23490"

},

{

"Tag": "BankEmiTotalDiscountCashbackAmountInPaise",

"Value": "0"

},

{

"Tag": "BankEmiTotalDiscountCashbackPerc",

"Value": "0",

"Tag": "Card Less Issuer Name",

"Value": "FEDERAL CARDLESS"

},

{

},

{

},

{

"Tag": "Card Less Host Txn Id",

"Value": "27368888PLABS_0120210714195235"

"Tag": "TransactionLogId",

"Value": "0"

}

]

}

}

6.2.15 Response Example of Federal Bank – Void Cardless Brand EMI

Request JSON

{ Request: { "TransactionNumber": "Test-10560", "SequenceNumber": "44", "AllowedPaymentMode": "24", "TotalInvoiceAmount": "120000", "StoreID": "061607000", "CustomerMobileNumber" : "9560312525", "Amount": "120000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "TxnType" : 1, "OriginalPlutusTransactionReferenceID" : 237967, "ClientID": "307639" } }

Response JSON

{

Response:

{

"ResponseCode": 1008,

"ResponseMessage": "TXN VOIDED",

"PlutusTransactionReferenceID": 237967,

"TransactionData": [

{

"Tag": "TID",

"Value": "0"

},

{

},

{

},

{

},

{

"Tag": "MID",

"Value": "7263"

},

{

"Tag": "PaymentMode",

"Value": "CARDLESS BRAND EMI"

},

{

"Tag": "Amount", "Value":

"1200"

"Tag": "BatchNumber",

"Value": "9524"

},

{

"Tag": "RRN",

"Value": ""

},

{

"Tag": "ApprovalCode",

"Value": ""

},

{

"Tag": "Invoice Number",

"Value": "121"

},

{

"Tag": "Masked Mobile Number",

"Value": "******6654"

},

{

"Tag": "Acquirer Id",

"Value": "00"

},

{

},

{

}, {

},

},

{

"Tag": "Acquirer Name",

"Value": ""

},

{

"Tag": "Transaction Date",

"Value": "01072021"

},

{

"Tag": "Transaction Time",

"Value": "122815"

},

{

"Tag": "AmountInPaisa",

"Value": "120000"

"Tag": "EmiTenureMonths",

"Value": "3"

"Tag": "EmiInterestRatePerc", "Value":

"135000"

"Tag": "EmiAmountInPaise",

"Value": "38858"

{

"Tag": "EmiTotalDiscountCashbackAmountInPaise",

"Value": "0"

},

{

"Tag": "EmiTotalDiscountCashbackPerc",

"Value": "50000"

},

{

"Tag": "EmiProductCode",

"Value": "45347845"

},

{

"Tag": "EmiProductName",

},

{

},

{

},

{

"Value": "LCD"

},

{

"Tag": "EmiProductSerial",

"Value": "170303D00019"

},

{

"Tag": "EmiManufacturerId",

"Value": "244"

},

{

"Tag": "Card Less Issuer Name",

"Value": "FEDERAL CARDLESS"

},

{

"Tag": "Card Less Host Txn Id",

"Value": "27368888PLABS_0120210701122736"

},

{

"Tag": "TransactionLogId",

"Value": "0"

}

]

}

}

6.2.16 Response Example of Twid Pay

Request JSON

{ Request: { "TransactionNumber": "Test-1039", "SequenceNumber": "2029", "AllowedPaymentMode": "25", "TotalInvoiceAmount": "100", "StoreID": "159640000", "Amount": "100" }, { }, { }, { }, "UserID": "krish", "MerchantID": "40605", "SecurityToken": "8c5d3f44-0a8a-4a3e-a530-f97cba15af48", "ClientID": "307639" } }

Response JSON

{

Response:

{

"ResponseCode": 0,

"ResponseMessage": "TXN APPROVED",

"PlutusTransactionReferenceID": 237599,

"TransactionData": [

{

"Tag": "TID",

"Value": "15042020"

},

{

"Tag": "MID",

"Value": "12842"

},

{

"Tag": "PaymentMode",

"Value": "TWID PAY"

},

{

"Tag": "Amount",

"Value": "1"

},

{

"Tag": "BatchNumber",

"Value": "9351"

},

{

"Tag": "RRN",

"Value": "39807"

"Tag": "ApprovalCode", "Value":

"000672" "Tag": "Invoice

Number", "Value":

"151"

"Tag": "Card Number",

"Value": ""

{

"Tag": "Acquirer Id",

"Value": "21"

},

{

"Tag": "Acquirer Name",

"Value": "twid"

},

{

"Tag": "Transaction Date",

"Value": "23122020"

},

{

"Tag": "Transaction Time",

"Value": "201427"

},

{

"Tag": "AmountInPaisa",

"Value": "100"

},

{

"Tag": "OriginalAmount",

"Value": "100"

},

{

"Tag": "FinalAmount",

"Value": "0"

}

},

{

},

{

},

{

},

]

}

}

6.2.17 Response Example of HDFC Flexipay - PoS (Pay Later)

Request JSON

{ Request: { "TransactionNumber": "Test-10560", "SequenceNumber": "44", "AllowedPaymentMode": "26", "TotalInvoiceAmount": "300000", "StoreID": "061607000", "CustomerMobileNumber" : "9560312525", "Amount": "300000", "UserID": "krish", "MerchantID": "7263", "SecurityToken": "19fb1540-6021-4193-9eb2-71ec602ccde5", "ClientID": "307639" } }

Response JSON

{ Response: { "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 6182, "TransactionData": [ { "Tag": "TID", "Value": "92133300" }, { "Tag": "MID", "Value": " " }, { "Tag": "PaymentMode", "Value": "PAYLATER EMI" }, { "Tag": "Amount", "Value": "3000" , { "Tag": "BatchNumber", "Value": "11" }, { "Tag": "RRN", "Value": "000020" }, { "Tag": "ApprovalCode", "Value": "00" }, { "Tag": "Invoice Number", "Value": "26" "Tag": "Card Number", "Value": "************3647" "Tag": "Expiry Date", "Value": "XXXX", "Tag": "Card Type", "Value": "MAESTRO" { "Tag": "Acquirer Id", "Value": "02" }, { "Tag": "Acquirer Name", "Value": "ICICI" }, { "Tag": "Transaction Date", "Value": "21072021" }, { }, { }, { }, { }, "Tag": "Transaction Time", "Value": "132513" }, { "Tag": "AmountInPaisa", "Value": "300000" }, { "Tag": "PaylaterEmiTenureDays", "Value": "15" }, { "Tag": "PaylaterEmiInterestRatePerc", "Value": "280000" }, { "Tag": "PaylaterEmiAmountInPaise", "Value": "300009" }, { "Tag": "PaylaterEmiTotalDiscountCashbackAmountInPaise", "Value": "0" }, { "Tag": "PaylaterEmiTotalDiscountCashbackPerc", "Value": "11500" }, { "Tag": "FinalAmount", "Value": "100" }, { "Tag": "TransactionLogId", "Value": "2148678864" } ] } }

6.2.18 Response Example of Gifticon

Request JSON

{ Request: { "TransactionNumber": "SEQ-SJ_SJ60", "SequenceNumber": 96, "AllowedPaymentMode": "29", "UserID": "SHUBHAM", "MerchantID": 29607, "SecurityToken": "ccce6673-d0cb-4cc5-a42d-08ec127e891e", "StoreID": "1221255000", "ClientID": "307639", "TotalInvoiceAmount": "50000", "Amount": "50000", "AutoCancelD1rationInMinutes" : 20, "TxnType" : 0, "OriginalPlutusTransactionReferenceID" : "238589", "CustomerMobileNumber" : "8305808684", "CustomerEmailID" : "shubham.jain01@pinelabs.com", "invoicenumber": "Abh4561", "BarcodeId": "6SXV-GRUQ-FRB8" } }

Response JSON

{ Response: { "ResponseCode": 0, "ResponseMessage": "APPROVED", "PlutusTransactionReferenceID": 238592, "AdditionalInfo": null } }

6.2.19 Response Example of Gifticon - Get Status

Request JSON

{ Request { "MerchantID": "29607", "SecurityToken": "ccce6673-d0cb-4cc5-a42d-08ec127e891e", "ClientID": "307639", "StoreID": "1221255000", "PlutusTransactionReferenceID": "238592" } }

Response JSON

{

Response

{

"ResponseCode": 0,

"ResponseMessage": "TXN APPROVED",

"PlutusTransactionReferenceID": 238592,

"TransactionData": [

{

"Tag": "PaymentMode",

"Value": "GIFTIICON"

},

{

"Tag": "Amount",

"Value": "500"

},

{

"Tag": "BatchNumber",

"Value": "41"

},

{

"Tag": "InvoiceNumber",

"Value": "216"

},

{

"Tag": "Transaction Date",

"Value": "22032022"

},

{

"Tag": "Transaction Time",

"Value": "141405"

},

{

"Tag": "TransactionNumber",

"Value": "SEQ-SJ_SJ60"

},

{

"Tag": "HOST_TID",

"Value": "ICICI041"

},

{

"Tag": "HOST_MID",

"Value": " "

},

{

"Tag": "RRN",

"Value": "000020"

},

{

"Tag": "ApprovalCode",

"Value": "00"

},

{

"Tag": "Acquirer Id",

"Value": "01"

},

{

"Tag": "Acquirer Name",

"Value": "ICICI"

},

{

"Tag": "TransactionLogId", "Value": "4295161638"

},

{

"Tag": "BarcodeId",

"Value": "6SXV-GRUQ-FRB8"

},

{

"Tag": "Masked Moblie Number",

"Value": ""

},

{

"Tag": "Wallet Txn Id New",

"Value": "GC_92P1T6FXBKXA"

},

{

"Tag": "Voucher ID",

"Value": "92P1T6FXBKXA"

},

{

"Tag": "Voucher Amount",

"Value": "29800"

}

]

}

}

6.2.20 Response Example of Magi PIN

Request JSON

{ Request { "TransactionNumber": "SEQ-SJ_25", "SequenceNumber": 96, "AllowedPaymentMode": "30", "UserID": "SHUBHAM", "MerchantID": 29607, "SecurityToken": "ccce6673-d0cb-4cc5-a42d-08ec127e891e", "StoreID": "1221255000", "ClientID": "307639", "TotalInvoiceAmount": "40000", "Amount": "40000", "AutoCancelD1rationInMinutes" : 20, "TxnType" : 0, "OriginalPlutusTransactionReferenceID" : "236539", "CustomerMobileNumber" : "8305808684", "CustomerEmailID" : "shubham.jain01@pinelabs.com", "invoicenumber": "Abh4561", } }

Response JSON

{

Response:

{

"ResponseCode": 0,

"ResponseMessage": "TXN APPROVED",

"PlutusTransactionReferenceID": 238492, "TransactionData": [

{

"Tag": "TID",

"Value": "ICICI041"

},

{

"Tag": "MID",

"Value": " "

},

{

"Tag": "PaymentMode",

"Value": "MAGICPIN"

},

{

"Tag": "Amount",

"Value": "400"

},

{

"Tag": "BatchNumber",

"Value": "27"

},

{

"Tag": "RRN",

"Value": "000020"

},

{

"Tag": "ApprovalCode",

"Value": "00"

},

{

"Tag": "Invoice Number",

"Value": "111"

},

{

"Tag": "Card Number",

"Value": "************0110"

},

{

"Tag": "Expiry Date",

"Value": "XXXX"

},

{

"Tag": "Card Type",

"Value": "VISA"

},

{

"Tag": "Acquirer Id",

"Value": "02"

},

{

"Tag": "Acquirer Name",

"Value": "ICICI"

},

{

"Tag": "Transaction Date",

"Value": "10032022"

},

{

"Tag": "Transaction Time",

"Value": "121301"

},

{

"Tag": "AmountInPaisa",

"Value": "40000"

},

{

"Tag": "OriginalAmount",

"Value": "40000"

},

{

"Tag": "FinalAmount",

"Value": "40000"

},

{

"Tag": "IsPartialPayByPointsTxn",

"Value": "True"

},

{

"Tag": "PartialAmountByCard",

"Value": "36000"

},

{

"Tag": "PartialAmountByReward",

"Value": "4000"

},

{

"Tag": "TransactionLogId",

"Value": "4295161402"

}

]

}

}

6.2.21 Respone Example of myEMI transactions

Request JSON

{ Request { "TransactionNumber": "SEQ-AJAY_MAR_0025", "SequenceNumber": 1, "AllowedPaymentMode": "37", "ClientID": "307639", "UserID": "RAVI", "MerchantID": "30090", "SecurityToken": "52dd0401-2db0-4f2f-8c0e-d71171688182", "TotalInvoiceAmount": "1000", "StoreID": "1225598000", "Amount": "250000", "TxnType": 0, "CustomerMobileNumber": "9886899363", "CustomerEmailID": "aman.shukla@pinelabs.com", "invoicenumber": "Abc4569" } }

Response JSON

{

Response

{

"ResponseCode": 0,

"ResponseMessage": "TXN APPROVED",

"PlutusTransactionReferenceID": 381659,

"TransactionData": [ {

"Tag": "TID",

"Value": "10012411"

},

{

"Tag": "MID",

"Value": ""

},

{

"Tag": "PaymentMode",

"Value": "MY EMI"

},

{

"Tag": "Amount",

"Value": "10000.00"

},

{

"Tag": "BatchNumber",

"Value": "12"

},

{

"Tag": "RRN",

"Value": "000020"

},

{

"Tag": "ApprovalCode",

"Value": "00"

},

{

"Tag": "Invoice Number",

"Value": "21"

},

{

"Tag": "Card Number",

"Value": "************1925"

},

{

"Tag": "Expiry Date",

"Value": "XXXX"

},

{

"Tag": "Card Type",

"Value": "VISA"

},

{

"Tag": "Acquirer Id",

"Value": "02"

},

{

"Tag": "Acquirer Name",

"Value": "ICICI"

},

{

"Tag": "Transaction Date",

"Value": "05122023"

},

{

"Tag": "Transaction Time",

"Value": "165530"

},

{

"Tag": "AmountInPaisa",

"Value": "1000000"

},

{

"Tag": "BankEmiTenureMonths",

"Value": "3"

},

{

"Tag": "BankEmiInterestRatePerc",

"Value": "140000"

},

{

"Tag": "BankEmiAmountInPaise",

"Value": "324083"

},

{

"Tag": "BankEmiTotalDiscountCashbackAmountInPaise",

"Value": "0"

},

{

"Tag": "BankEmiTotalDiscountCashbackPerc",

"Value": "0"

},

{

"Tag": "EmiLoanAmountInPaise",

"Value": "950000"

},

{

"Tag": "InstantDiscountAmountInPaise",

"Value": "50000"

},

{

"Tag": "FinalAmount",

"Value": "950000"

},

{

"Tag": "CardType",

"Value": "Credit Card"

},

{

"Tag": "TransactionLogId",

"Value": "4295278093"

},

{

"Tag": "Card Holder Name",

"Value": "VIKASH KUMAR"

},

{

"Tag": "Currency Type",

"Value": "INR"

}

]

}}

6.2.22 Response Example of Sale with Tip transactions

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 251678, "TransactionData": [ { "Tag": "TID", "Value": "28060098" }, { "Tag": "MID", "Value": " " }, { "Tag": "PaymentMode", "Value": "" }, { "Tag": "Amount", "Value": "100.00" }, { "Tag": "BatchNumber", "Value": "4" }, { "Tag": "RRN", "Value": "000020" }, { "Tag": "ApprovalCode", "Value": "00" }, { "Tag": "Invoice Number", "Value": "15" }, { "Tag": "Card Number", "Value": "************6753" }, { "Tag": "Expiry Date", "Value": "XXXX" }, { "Tag": "Card Type", "Value": "MASTERCARD" }, { "Tag": "Acquirer Id", "Value": "01" }, { "Tag": "Acquirer Name", "Value": "HDFC" }, { "Tag": "Transaction Date", "Value": "10012024" }, { "Tag": "Transaction Time", "Value": "165059" }, { "Tag": "AmountInPaisa", "Value": "10000" }, { "Tag": "OriginalAmount", "Value": "10000" }, { "Tag": "FinalAmount", "Value": "11000" }, { "Tag": "TransactionLogId", "Value": "4295208072" }, { "Tag": "Card Holder Name", "Value": "SURABHI MAHAWAR " }, { "Tag": "Currency Type", "Value": "INR" }, { "Tag": "Amends", "Value":"[{\"key\":\"TIP\",\"name\":\"SalePlusTIP\",\"amount\":\"1000\",\"crdr\":\"CR\",\"addInfo\":\"\"}]" }, { "Tag": "CurrencyMinorUnit", "Value": "2" } ] }

6.2.23 Response Example of Pay By Link transactions

Please note that ‘TransactionLogId’ in response will be PayByLink reference ID.

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 339044, "TransactionData": [ { "Tag": "TID", "Value": "36380612" }, { "Tag": "MID", "Value": "120067" }, { "Tag": "PaymentMode", "Value": "BRAND EMI" }, { "Tag": "Amount", "Value": "9900.00" }, { "Tag": "BatchNumber", "Value": "9103" }, { "Tag": "RRN", "Value": "42587096720" }, { "Tag": "ApprovalCode", "Value": "999999" }, { "Tag": "Invoice Number", "Value": "112" }, { "Tag": "Card Number", "Value": "************1234" }, { "Tag": "Expiry Date", "Value": "XXXX" }, { "Tag": "Card Type", "Value": "VISA" }, { "Tag": "Acquirer Id", "Value": "03" }, { "Tag": "Acquirer Name", "Value": "HDFC" }, { "Tag": "Transaction Date", "Value": "24012024" }, { "Tag": "Transaction Time", "Value": "185956" }, { "Tag": "AmountInPaisa", "Value": "990000" }, { "Tag": "EmiTenureMonths", "Value": "6" }, { "Tag": "EmiInterestRatePerc", "Value": "40000" }, { "Tag": "EmiAmountInPaise", "Value": "158888" }, { "Tag": "EmiTotalDiscountCashbackAmountInPaise", "Value": "0" }, { "Tag": "EmiTotalDiscountCashbackPerc", "Value": "40000" }, { "Tag": "EmiProductCode", "Value": "45347845" }, { "Tag": "EmiProductName", "Value": "LCD" }, { "Tag": "EmiProductSerial", "Value": "1234567890" }, { "Tag": "EmiManufacturerId", "Value": "244" }, { "Tag": "EmiProductAmountInPaise", "Value": "990000" }, { "Tag": "EmiLoanAmountInPaise", "Value": "943811" }, { "Tag": "InstantDiscountAmountInPaise", "Value": "10000" }, { "Tag": "EmiTotalSubventionAmountInPaise", "Value": "37692" }, { "Tag": "SubventionType", "Value": "Instant" }, { "Tag": "FinalAmount", "Value": "100" }, { "Tag": "BrandEmiConvenienceAmountInPaise", "Value": "1503" }, { "Tag": "CardType", "Value": "Debit Card" }, { "Tag": "TransactionLogId", "Value": "37" }, { "Tag": "Card Holder Name", "Value": "Amit kumar " }, { "Tag": "CurrencyMinorUnit", "Value": "2" } ] }

6.2.24 Response Example Rewards

JSON

{ "ResponseCode": 0, "ResponseMessage": "TXN APPROVED", "PlutusTransactionReferenceID": 389504, "TransactionData": [ { "Tag": "TID", "Value": "10010100" },{ "Tag": "MID", "Value": "7263" },{ "Tag": "PaymentMode", "Value": "POINTS REDEMPTION" },{ "Tag": "Amount", "Value": "100.00" },{ "Tag": "BatchNumber", "Value": "9026" },{ "Tag": "RRN", "Value": "0" },{ "Tag": "ApprovalCode", "Value": "00000000" },{ "Tag": "Invoice Number", "Value": "126" },{ "Tag": "Card Number", "Value": "************6753" },{ "Tag": "Expiry Date", "Value": "XXXX" },{ "Tag": "Card Type", "Value": "REWARD" },{ "Tag": "Acquirer Id", "Value": "81" },{ "Tag": "Acquirer Name", "Value": "State Bank Rewardz" },{ "Tag": "Transaction Date", "Value": "01022024" },{ "Tag": "Transaction Time", "Value": "172532" },{ "Tag": "AmountInPaisa", "Value": "10000" },{ "Tag": "OriginalAmount", "Value": "10000" },{ "Tag": "FinalAmount", "Value": "0" }, { "Tag": "TransactionLogId", "Value": "0" },{ "Tag": "Card Holder Name", "Value": "SURABHI MAHAWAR " }, { "Tag": "Reward Txn ID", "Value": "00000000" }] }

7. CancelTransaction API:

Merchant billing Application will be able to cancel transaction if status of transaction is still open by using this API.

7.1 Request Parameters:

| S No. | Parameter | Description | Type | Sample Values | Mandatory(M)/ Optional(O) |

| 1 | MerchantID | Will be allotted by Pine Labs to Merchant. | N | 1234 | M |

| 2 | SecurityToken | Will be allotted | by Pine Labs to Merchant.AN | 70D7509C-0A90-4938-A7F9-DB99B9B841D9 | M |

| 3 | StoreID | Merchant Store ID. | N | 61607 | M |

| 4 | ClientID | POS/Client ID. | N | 307639 | C |

| 5 | PlutusTransactionReferenceID | Unique numeric Value linked with the transaction received from Pine Labs in original request. | N | 123456 | M |

| 6 | Amount | Amount to be processed in paisa. | N | 100000 | M |

| 7 | AdditionalInfo | Reserved for Future Use. It will be array of JSON objects with Tag and Value pair. | AN | O |

Example JSON

JSON

{ “MerchantID”: 1234, “SecurityToken”: “70D7509C-0A90-4938-A7F9-DB99B9B841D9”, "ClientID": “123456789012345”, "StoreID": "12301001", "PlutusTransactionReferenceID": 501, "Amount ":100000 }

7.2 Response Parameters:

| S No. | Parameter | Description | Type |

| 1 | ResponseCode | 0 in case of Success Non 0 means failure. | N |

| 2 | ResponseMessage | Description of error in case of Declined otherwise “APPROVED”. | AN |

Response Example

JSON packet for success response

JSON

{ "ResponseCode": 0, "ResponseMessage": "APPROVED", }

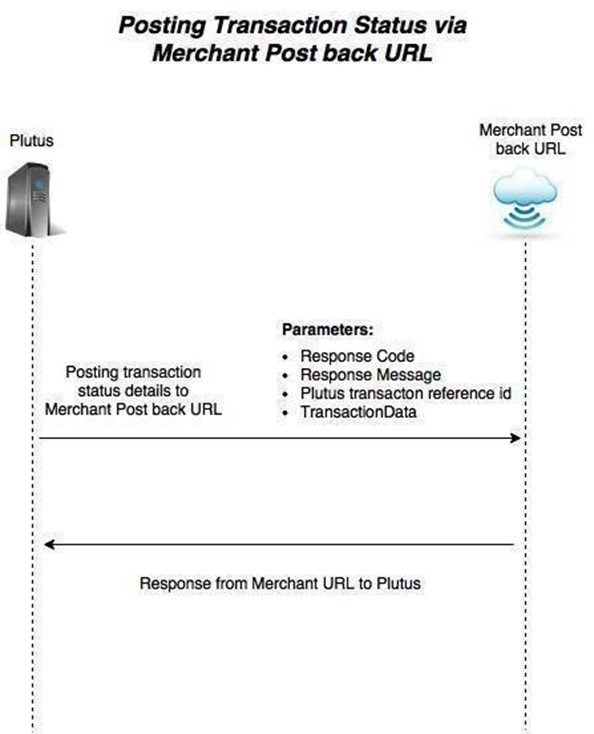

8. Post Back URL:

In this approach Merchant will provide URL (IP/Port) to Pine Labs and Pine Labs will Post transaction data for real time update.

8.1 Sample Packet:

JSON

{ POST /somepage.php HTTP/1.1 Host: example.com Content-Type: application/x-www-form-urlencoded Content-Length: 373 ResponseCode=0, ResponseMessage=APPROVED, PlutusTransactionReferenceID=79845, TransactionNumber=33A9A2D5-6393-49C6-9BC4- 043700CA2DD1,BankTID=79789879,BankMID= ,PaymenMode=CARD,Amount=10000,ApprovalCode =00,RRN=000020,Invoice=12,BatchNumber=6,CardNumber=************7453,ExpiryDate=XXXX,Acquirer Code=1,AcquirerName=HDFC,TransactionDate=25012021,TransactionTime=133919,CardType=MAESTRO }

9. Flow Diagrams

9.1 Terminal Transaction Flow:

9.1.1 Manual entry of Transaction Ref # on PoS – Multiple Pay Modes

9.1.2 Manual entry of Transaction Ref # on PoS – Multiple Single Pay Mode

9.1.3 Transaction Ref ID selection on PoS – Multiple Pay Modes

9.1.4 Transaction Ref ID selection on PoS – Single Pay Mode

9.1.5 Single Open Transaction Ref ID available

9.2 Updating Transaction Status to Merchant:

9.3 Updating Transaction Status to Merchant via post back URL: